IFRS-15 Compliance: SAP Revenue Accounting and Reporting Integration with SAP BRIM

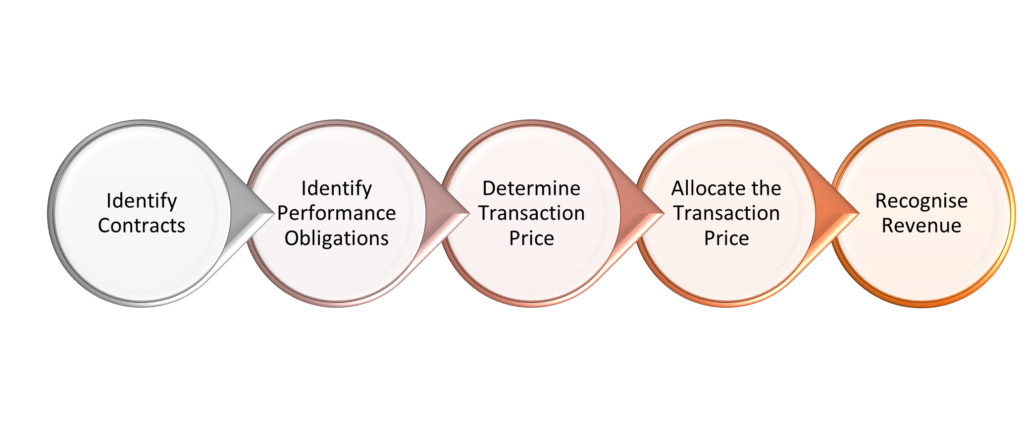

SAP Revenue Accounting and Reporting supports compliance with IFRS-15 (Revenue from Contracts with Customers) standards for multiple component contracts or contracts for revenue recognition fulfilled on a time and/or event basis. Revenue Accounting and Reporting (RAR) enables you to manage revenue recognition in a process that involves the following high-level steps:

- Identify contracts: In this step, you create revenue accounting contracts corresponding to operational documents that are created on a back-end operational system.

- Identify performance obligations: In this step, you identify the performance obligations included in each contract. You create performance obligations for items in the operational document and manage their relationships with one another.

- Determine transaction price: In this step, you determine the total price by aggregating the pricing conditions passed from the back-end operational system.

- Allocate the transaction price: In this step, you allocate the total price (determined in the previous step) among the performance obligations based on the allocation method, such as standalone selling price-weighted, standalone selling price tolerances, residual price allocation, etc.

- Recognize Revenue: In this step, you recognize revenue for fulfilled performance obligations and make appropriate postings to the general ledger regularly to reflect revenue-related transactions.

Revenue Accounting and Reporting (RAR) can easily integrate with other SAP components (such as Sales & Distribution; Billing and Revenue Innovation Management; SAP Customer Relationship Management; SAP S/4 HANA Service) and/or non-SAP components (such as Oracle, etc.).

In this blog, I want to focus on the SAP Revenue Accounting and Reporting (RAR) integration with SAP Billing and Revenue Innovation Management (BRIM) installed and activated in the same system. With SAP Billing and Revenue Innovation Management, SAP provides an integrated solution for the entire order-to-cash process that comprises Subscription Order Management, Convergent Mediation by DigitalRoute, Convergent Charging, Convergent Invoicing, Contract accounting, and Customer Financial Management. It covers the entire process chain, starting with product and subscription modeling that enables the customer to manage subscription and usage-based data as well as pricing and charging processes. It also integrates with high-volume billing and financial customer care powered by SAP S/4 HANA.

IFRS compliance is ensured by using integration with Revenue Accounting and the Offer-to-Cash end-to-end process as part of Billing and Revenue Innovation Management (BRIM). The prerequisites for this integration are:

- You are using Contract Accounts Receivable and Payable (FI-CA), Convergent Invoicing, and provider contracts.

- You have activated the business function FICA_EHP7_RA (Integration with Revenue Accounting) in SAP S/4 HANA.

Within the end-to-end process, integration with Revenue Accounting (FI-RA) exclusively uses Convergent Invoicing in the S/4HANA system. Convergent Invoicing sends all required data to Revenue Accounting. This ensures IFRS 15 compliance.

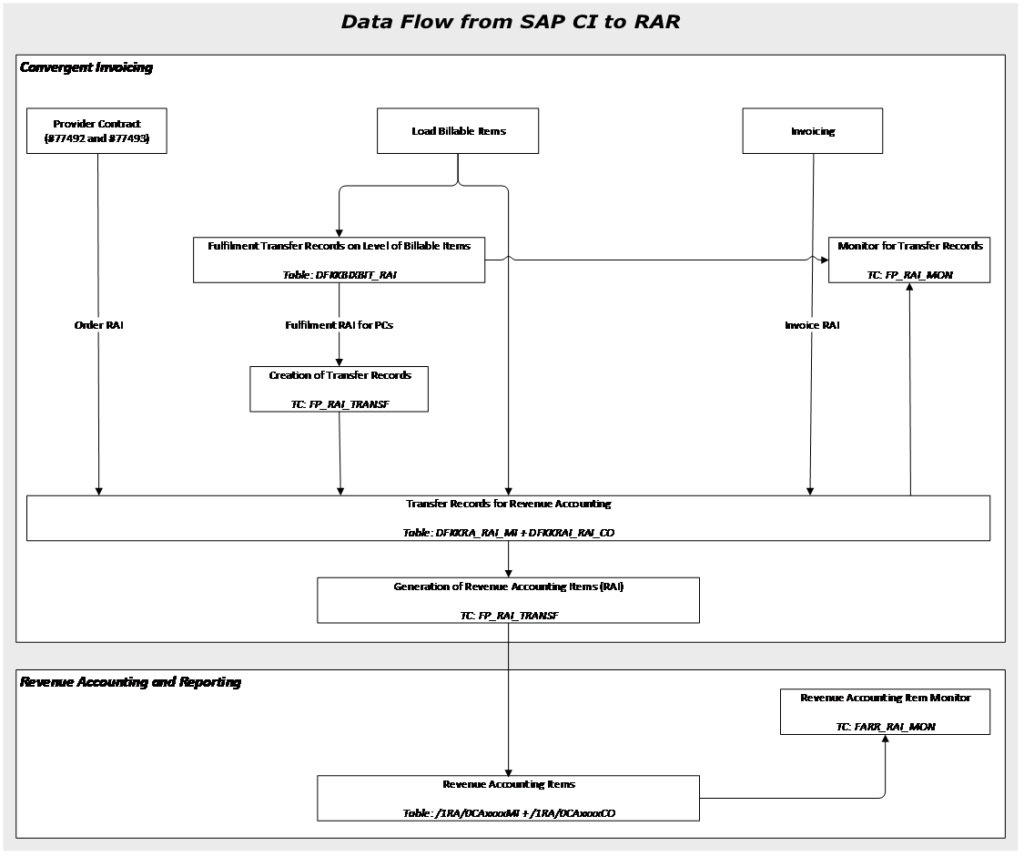

In the Offer-to-Cash process, Convergent Invoicing records transfer records for Revenue Accounting. Based on these transfer records, Convergent Invoicing creates revenue accounting items in the inbound processing of Revenue Accounting. Order items, fulfilment items, and invoice items are created.

Data changes made by functions and processes outside Convergent Invoicing do not result in an update to Revenue Accounting. This includes, for example, all processes in Contract Accounts Receivable and Payable, such as the following:

- Manual posting of documents

- Write-Offs

- Document reversal

- Transfer of items

- Value adjustments

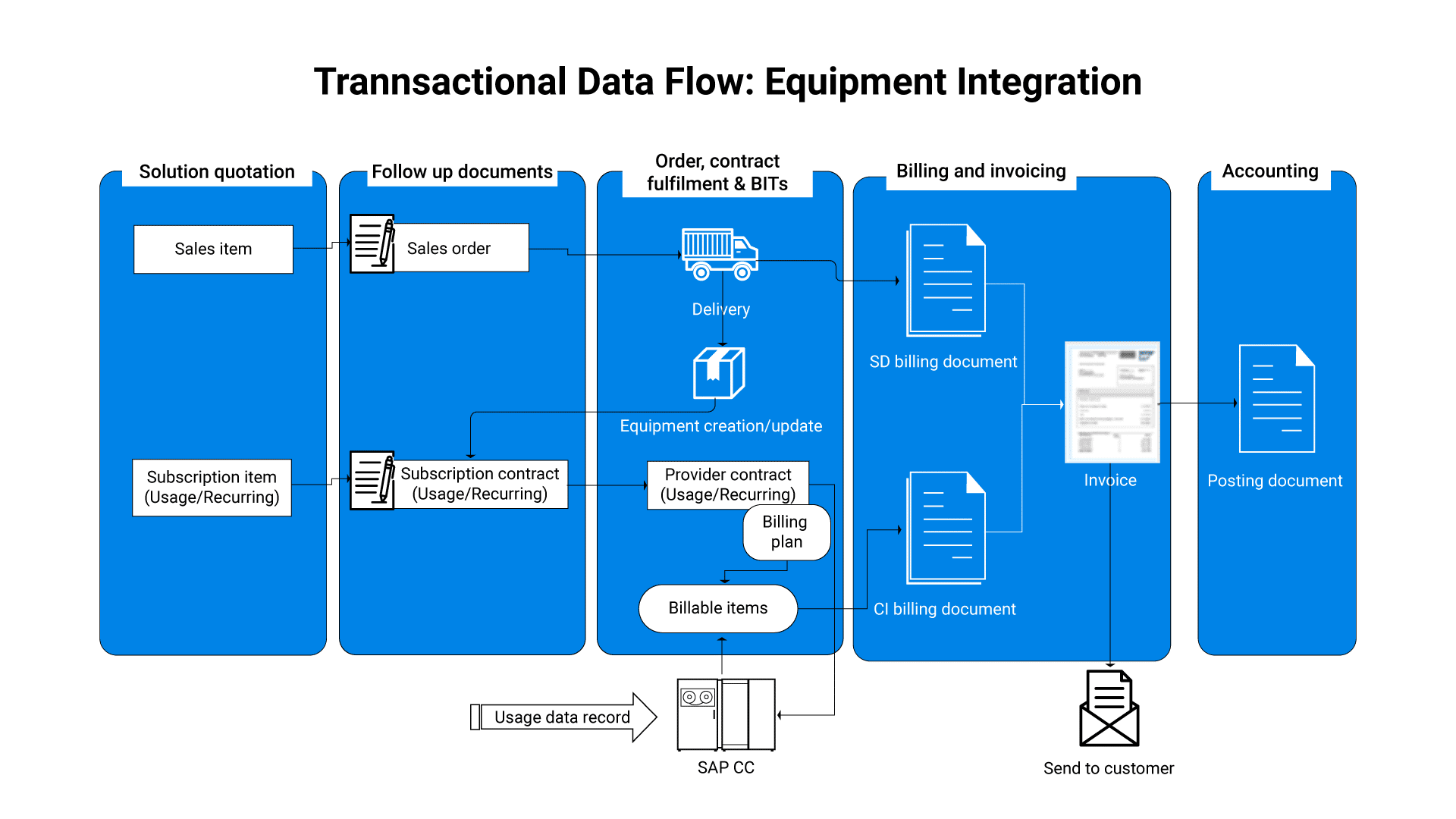

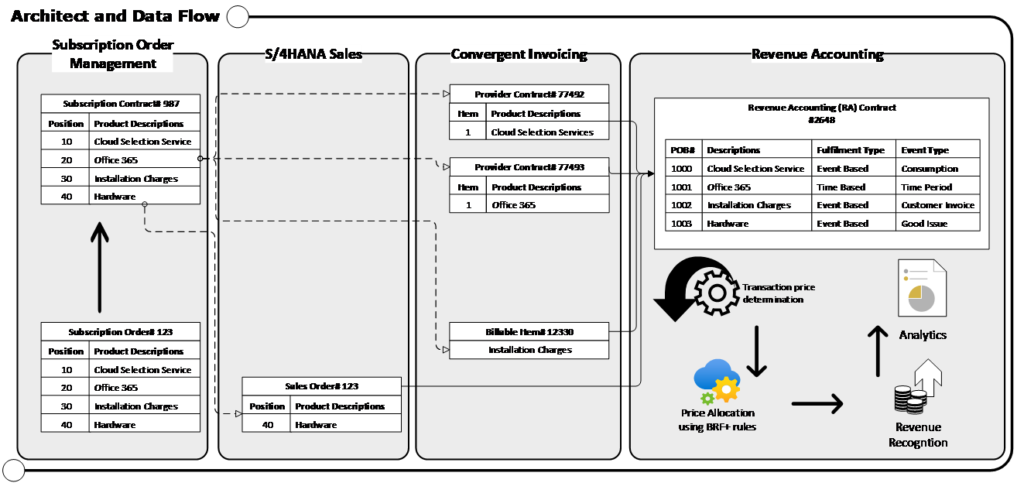

The following graphical presentation illustrates the process flow of transactional data depicting a bundle product consisting of hardware, subscription software, and installation charges.

In S/4HANA Subscription Order Management (SOM), you create a subscription order for the sale of product bundles (subscription packages) consisting of cloud selection service, Office 365, installation charges, and hardware. Based on the subscription order, the system automatically creates subscription contract documents in SOM and provider contracts in Convergent Invoicing for the subscription products such as cloud selection service and Office 365, as shown above in the figure. For the installation charges (shown above in the figure), the system automatically creates billable items. Hardware (a tangible product) is transferred to S/4HANA Sales and Distribution directly from SOM Order to execute the delivery of the product to the client site for installation, as shown in the figure above.

In SAP BRIM, provider contracts represent customer contracts. The contract management system transfers the required provider contract data to SAP Convergent Charging (CC) and Convergent Invoicing (CI). Convergent Invoicing passes on to Revenue Accounting the information relevant for creating order items. In the above figure, you can see the provider contracts (#77492 and #77493) are passed on to Revenue Accounting with all the relevant information for creating revenue accounting contracts and performance obligations. Installation charges (One-Off charges) for which the customer is invoiced once are transferred as billable items from SOM to CI and finally to revenue accounting. The following graphical presentation illustrates the data flow from Convergent Invoicing to Revenue Accounting for a bundle product consisting of subscription software and installation charges.

In Revenue Accounting, data is updated using revenue accounting items (RAI). In general, revenue accounting supports the following types of revenue accounting items: order items, fulfilment items, and invoice items. The graphic above shows how convergent invoicing creates transfer records in different processes (depending on the service type assignment to a provider contract item, billable item, or invoicing document), from which transaction FP_RAI_TRANSF creates the following revenue accounting items:

- Order items from provider contracts (#77492 and #77493) and from installation charges that are transferred to the system as billable items.

- Fulfillment items during the transfer of billable items to rated consumption.

- Invoicing items from Invoicing.

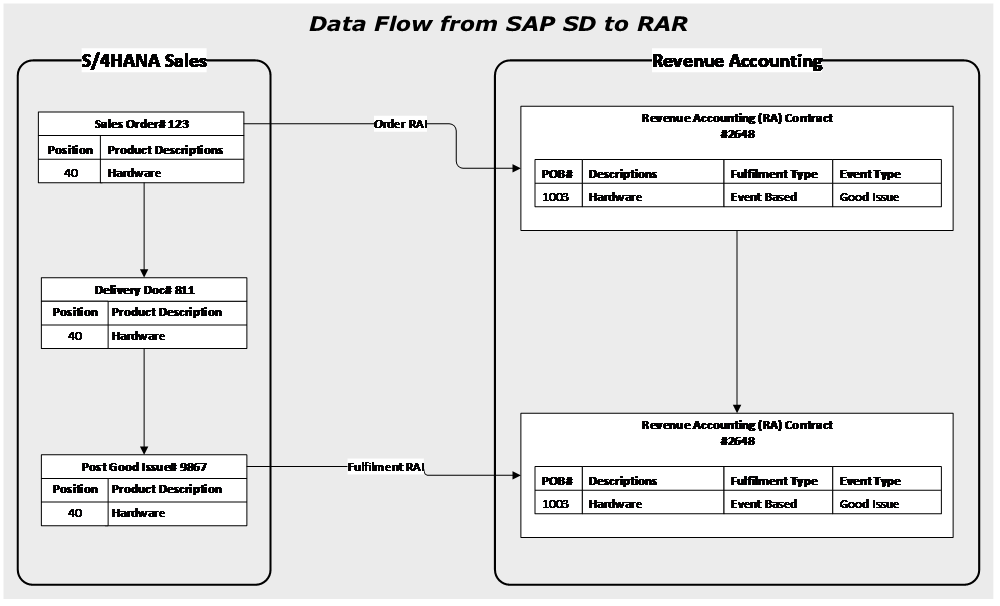

Hardware items are transferred to S/4HANA Sales and Distribution for delivery and billing using the exchange in service feature in SAP S/4HANA. The sales order (having the same order ID and position) creates and transfers order RAI to the revenue accounting system as shown in the figure below.

Upon the successful delivery of the hardware to the client site for installation, the system automatically creates and transfers fulfilment RAI to the revenue accounting system, as shown above in the figure.

In Revenue Accounting and Reporting (RAR), the system automatically creates revenue contracts and performance obligations based on the configuration (i.e., POB type). Standalone selling prices are assigned to performance obligations using BRF+ settings. The transaction price of the revenue accounting contract is assigned to the performance obligations in accordance with the relative selling prices. Costs are likewise allocated to performance obligations. The revenues and costs from fulfilled performance obligations are recognized and posted in the general ledger.

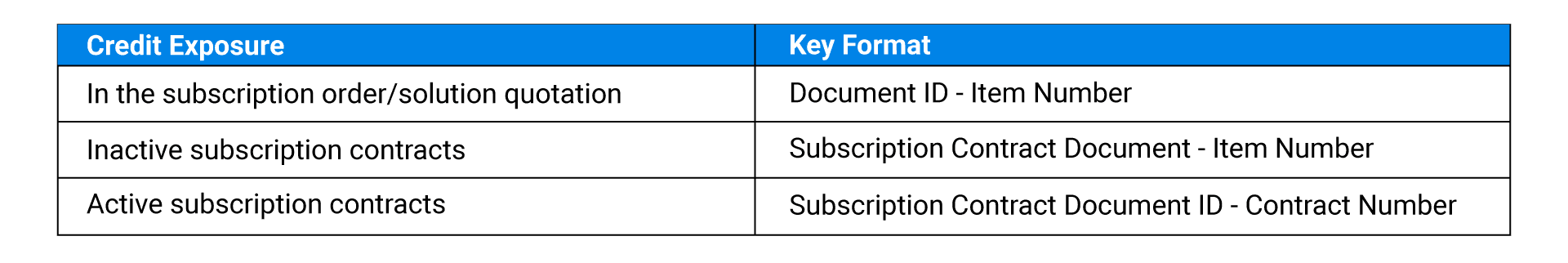

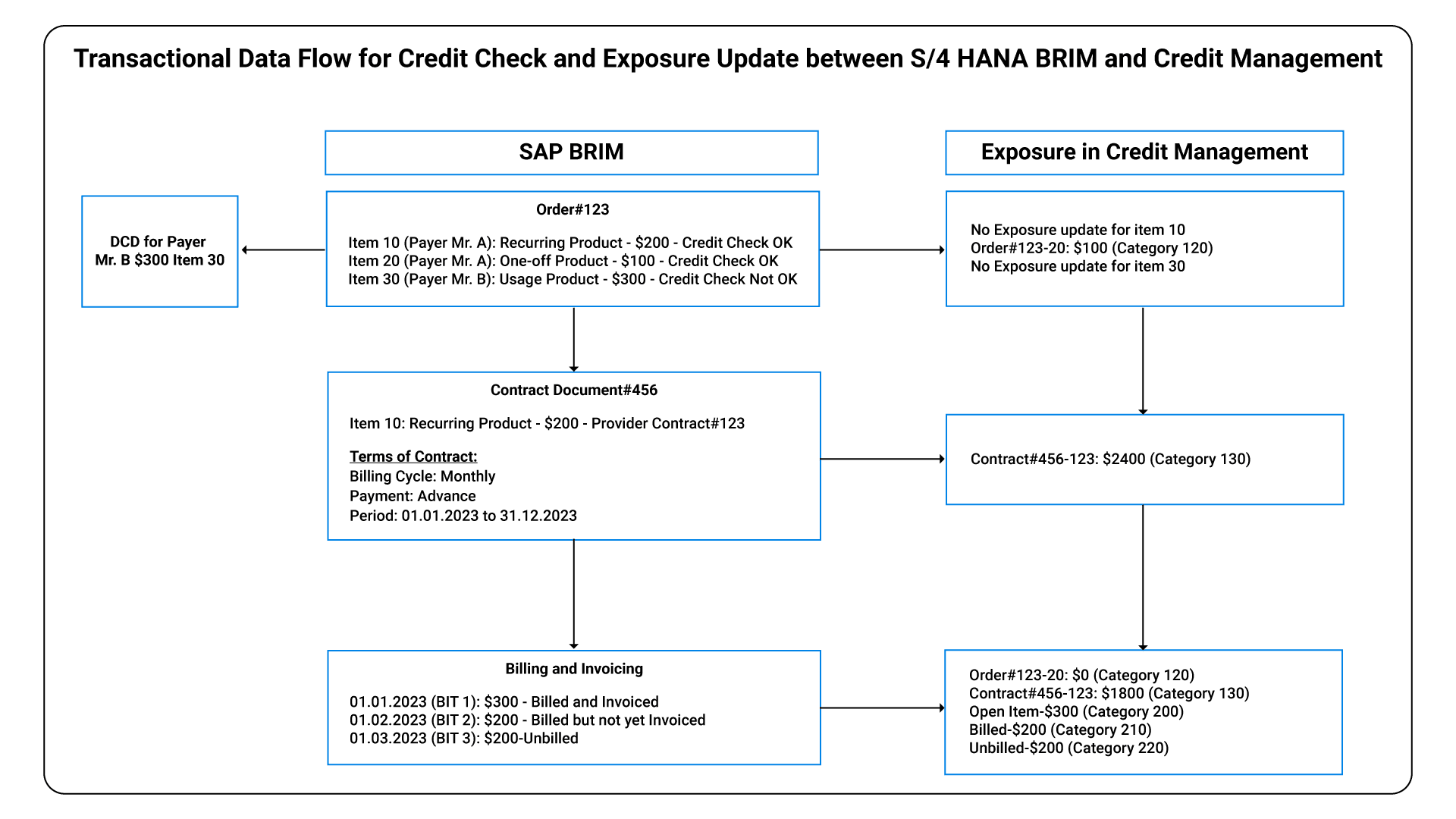

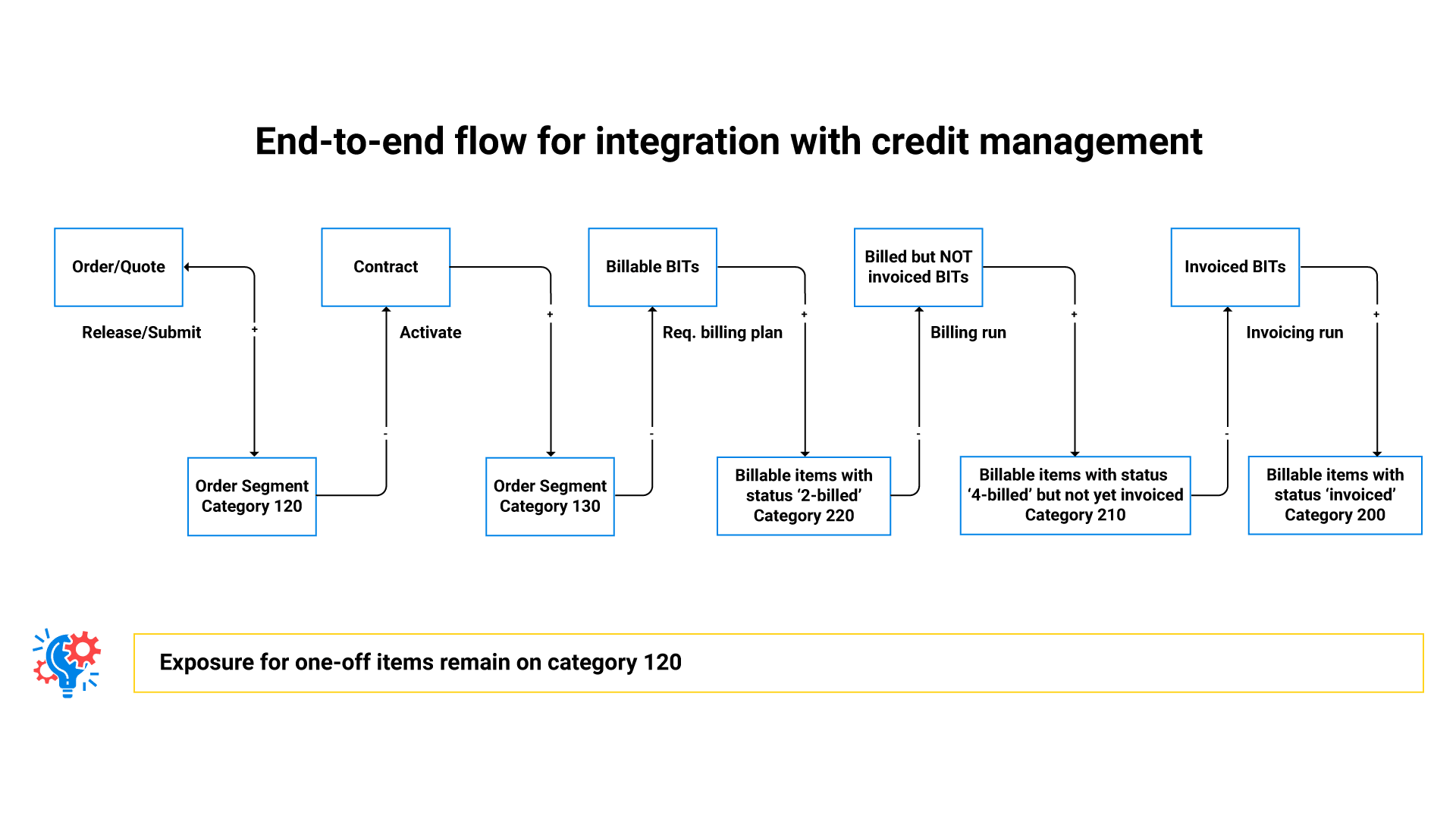

The subscription-specific credit exposure is created on an item or contract level with the following object keys in credit management:

The subscription-specific credit exposure is created on an item or contract level with the following object keys in credit management: